Article 3: A look at the archdiocese’s financial investments

For the mutual benefit of the Archdiocese of Grouard-McLennan and its parishes, we are working in close collaboration with UMC Financial Management, an independent investment and financial consulting firm from Edmonton. This includes the mortgages of commercial properties. On the other side, Montrusco Bolton, also an independent asset management firm, are helping us to invest in the stock market to maximize the investment of the Archdiocese and its parishes and minimize banking fees. Both investing companies are following the ethical policy of the Archdiocese.

Assuring that the investment is part of a diversified professionally managed portfolio, it is the responsibility of hthe Archdiocesan Finance Council to monitor these accounts closely. By pooling the excess fund with the archdiocese, the parishes investment returns are much more significant than if they would be invested individually.

The benefits of this policy have been outlined in the past and still are valid today:

- Local Pastors and Parish Finance Councils are relieved of making decisions with regard to what period of time to invest their funds with the local bank or financial institution that will meet the estimated cash needs of their parish annually.

- The Pastor, in conjunction with his Parish Finance Council, still has access to these funds without an interest penalty.

- There is no minimum investment balance required for parishes

- The average annual rate of return paid by the Archdiocese of Grouard-McLennan to the parish has always been higher than what the parish could earn on its own.

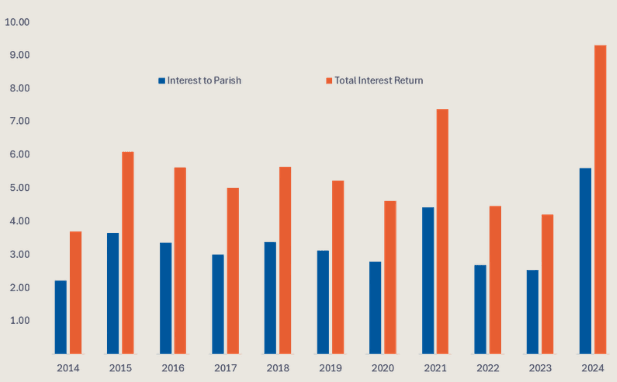

- In a joint investment partnership agreement with the archdiocese and parishes, the operating costs for the Archdiocese benefits by the 40% of the annual returns earned on these funds, and the parish receives 60%.

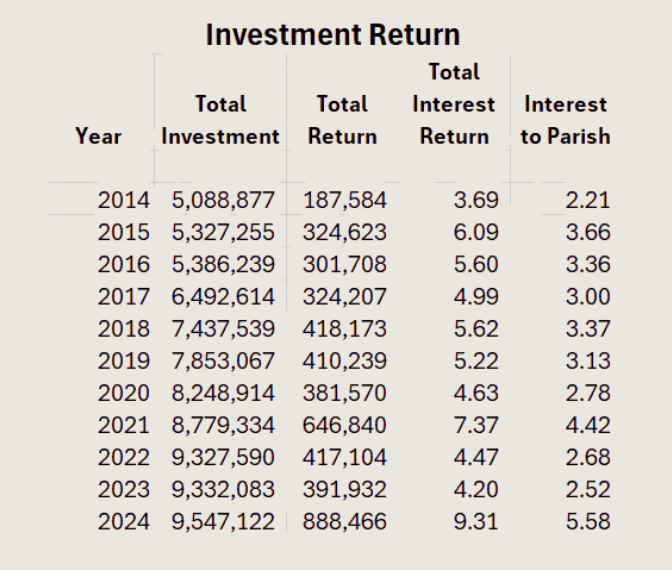

Below, see rate of return for the past 10 years:

Annually, the Archdiocese provides a statement to each parish summarizing the beginning balance, the contributions and withdrawals, the interest earned and the year end balance.

Cash Management

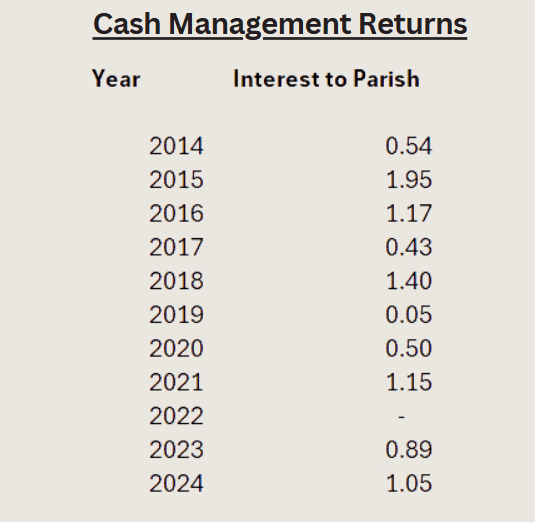

In 1997, the Archdiocese of Grouard-McLennan entered into a partnership with UMC and the Royal Bank of Canada (RBC) where all parishes in the Archdiocese were invited to join a Consolidated Banking Arrangement. The general concept is that there are cost savings and income benefits to be earned by having the Archdiocese and parishes banking together as a group. Individual parishes continue to own, operate and control their own bank accounts.

The benefits of this arrangement are:

- Improve the returns earned by all participants.

- No bank charges to individual accounts and parishes.

- Individual parishes will not be charged for overdraft charges nor experience NSF fees.

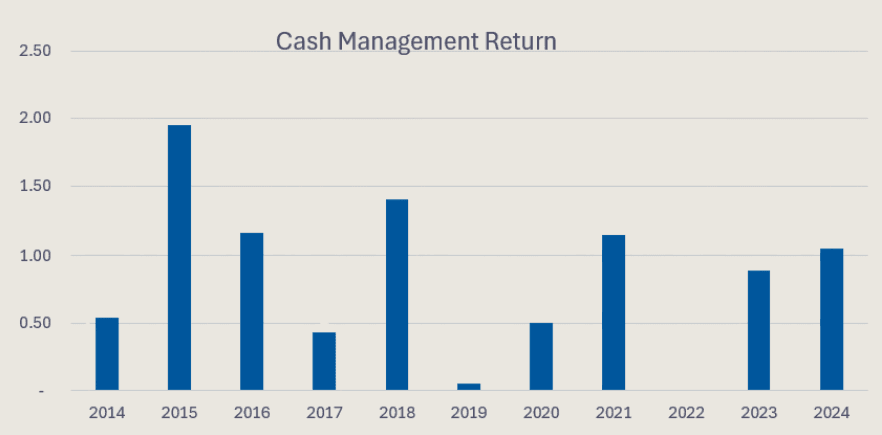

- Archdiocese benefits by earning the difference between the portfolio return and interest paid to the participants.

On the graph below you can see rate of return in the past 10 years:

For further clarification, contact the Finance Administrator through the chancery at 780-532-9766,